If we consider all internet shoppers and calculate an average, approximately 19 online transactions per person per year take place, worldwide.

As opposed to in-person fraud, online fraud has now accounted for 58% of total cases – in the year 2016.

Moreover, every 7 out of 10 purchasers go ahead in transactions based on what payment gateway method is available.

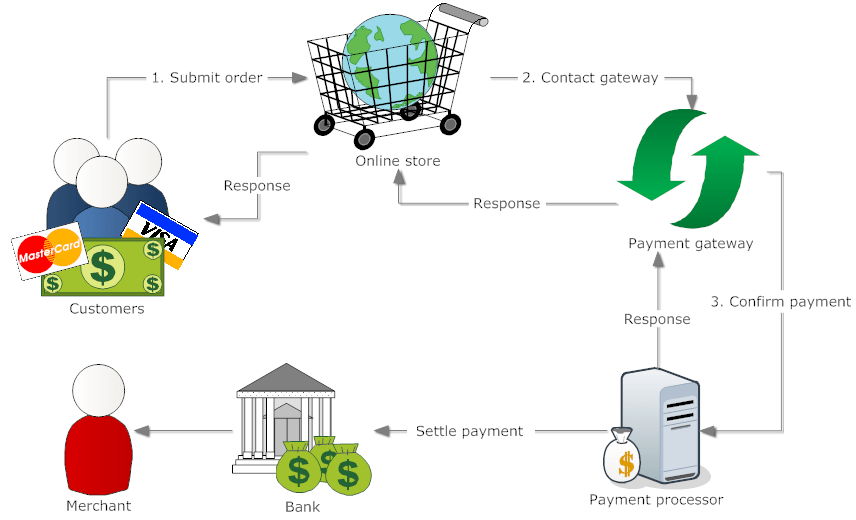

Backend order processing is often an overlooked part of eCommerce.

Backend order processing is often an overlooked part of eCommerce.

Business owners invest a handsome amount of money to design eye-catching websites but give little importance to payment delivery methods.

Today, in the 2010s/2020s, consumers all over the globe expect

- 360 degree flexible and

- secure

I shall not mention here basics such as what is a payment gateway and why you need to have one – I know you are there, well-versed with all these things already.

Your business can increase profit margins by far with help of the right payment gateway installed on a website that offers

- superfast bills payment

- automatic debit or credit for recurring transactions

Bottom line is that a payment gateway should aid in extra care, be human-friendly to use, and easy on the pocket. It keeps customers on track – toward transaction completion.

Complicated check-out or weak merchant processor results in more visitors bouncing from an eCommerce store.

List of Payment Gateways Integrating Better with Magento Website

Choosing a payment gateway to deploy on the Magento store should be an elaborate process as opposed to random tryouts.

What ultimately lies at the heart of all business activities is phenomenal customer experience. And not every payment gateway can be said as proficient that delivering the required level of user experience.

Associated is some type of risk with every form of payment – whether in terms of:

- security

- capabilities

- pricing or

- Convenience

Selecting a Magento 2 payment gateway hugely depends on personal preference.

How good it may be performing when used in solicit manner, what website owners ought to seek is the degree of Magento payment gateway integration that is possible while attaching a specific brand payment gateway to the online store. Impeccable payment gateway delivers high remunerations.

Each brand of Magento 2 payment module brings unique advantages.

Let us quickly understand the benefits of the Magento payment gateway by taking a look at the facilities/pros and cons of the top 11 best payment gateways for Magento

There may exist a couple of other payment gateways that are not mentioned here. I have carefully selected widely used payment systems that work discreetly when used in conjunction with the Magento eCommerce framework/website.

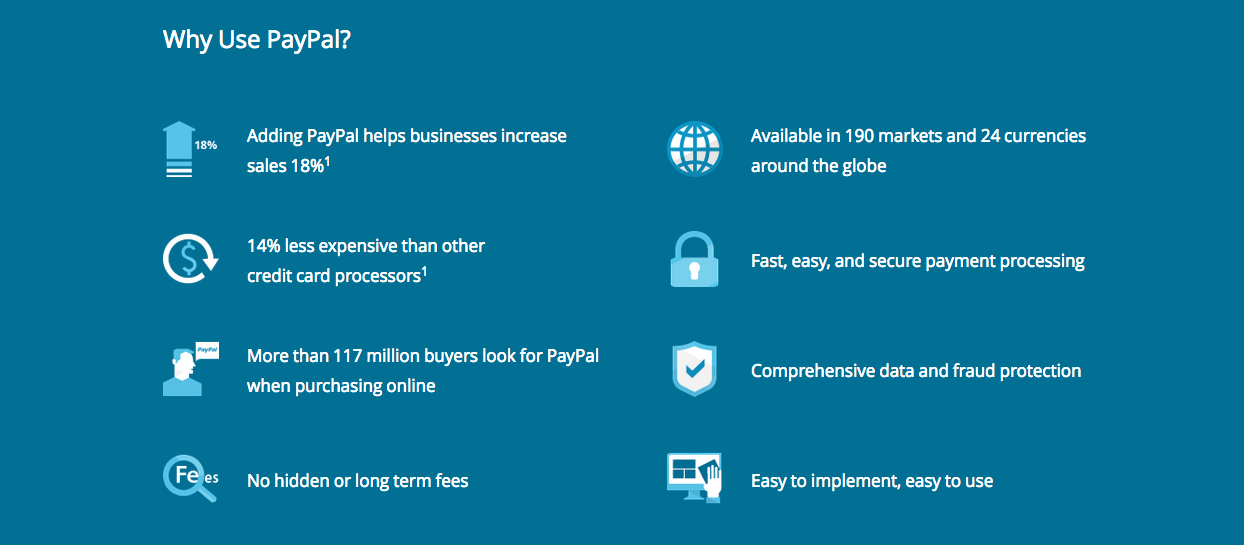

PayPal

If you are inclined to have a very secure and first-tier payment system on your website, PayPal is at the top of the list.

You don’t have to pay anything while doing setup or using PayPal services inside the Magento web store. Further, it is quick. If you need to transact right now, just spend 5 minutes and you have started.

On average, PayPal processes $5 billion in payments every year without any errors.

Once installed on Magento, it explores full options where money can be sent or received via-

- credit card or

- user’s PayPal account

Also, notification mail to both parties is automatically dispatched when it completes successfully.

Considerations before you Sign-Up for a PayPal account

Just one thing.

While PayPal does not ask for any fees to start and use its money transfer facility, its charge per transaction is a bit higher in comparison with analogous software.

On each transaction, the receiver will incur a cost of 2.9% + $0.30 USD of the total amount.

2. Authorize.Net

Image Source: Authorized.Net

Authorize.net is a software product from CyberSource Solutions, USA, and has been around since 1996.

It is perfectly suited for small and mid-size businesses.

Moreover, it comes packed with multiple security measures such as

- advanced fraud detection suite, free

- address and CVV verification

- layered checking, i.e. OTP numbers on mobile or email

etc.

The thing I like the most about Authorize.Net:

Users can save their data including credit card numbers without any worries. Authorize.net handles and stores all customers’ data with tight conservation using its Customer Information Manager (CIM) component.

Considerations before you Sign-Up for an Authorize.Net account-

Your business should be based in any of the following countries, otherwise, its services are not for you:

- United States

- United Kingdom

- Canada

- Europe

- Australia

Authorize.Net charges no less than PayPal, i.e. your business would be suffering an additional cost of 2.9% + $0.30 USD of the total amount when receiving money in your Authorize.net account.

3. Amazon Payments

Headquartered in Seattle, Washington, United States, Amazon Pay is a subsidiary of Amazon company.

If you are in search of a fast payment gateway available for no setup fees, Amazon Payments has that unprecedented feature.

Customers are provided with a widget where they will enter a shipping address, payment options, etc.

For WordPress website owners, it is extremely easy to enable Amazon Payments as all it requires is the installation of a plug-in.

Charges same, 2.9% + $0.30 USD of the total amount of receiving money.

4. 2Checkout

Image Source: 2checkout.com

Briefly, it has

- excessive global reach, 87 currencies, and 15 languages

- recurring billing option available with membership

- 100% reliable, integrates with 90+ shopping carts

- no coding required

- vigilance against vulnerability, 300+ fraud rules

For the United States, its charge is unified in conjunction with other payment gateways, i.e. 2.9% + $0.30 USD of the total amount when receiving money

Good discounts are offered to businesses that have processed 50,000 USD per month.

Fees per transaction vary from country to country.

5. Braintree

Image Source: Braintreepayments.com

Braintree is a division of PayPal, Chicago.

Its offers state-of-the-art payment features to e-commerce companies, especially for mobile and web-enabled systems.

For qualified or Braintree-acceptable cards, the transaction fee is 2.9% + $0.30 USD of the total amount when receiving money.

Zero cost for setup and merchant account sign-up.

Geographic regions served:

- US

- Europe

- Canada

- Hong Kong

- Singapore

- Malaysia

- Australia

- New Zealand

6. Google Pay Send

Formerly known as Google Wallet, it is an extraordinarily lightweight peer-to-peer payment processing system designed by Google.

Due to the plenty of benefits that it nurtures, it is considered the main rival of PayPal.

No cost for sign-up, debit, or credit transaction to sender or receiver – up to a certain limit. Please check its first source website to know the details.

User-facing screens can be translated into 6 languages, and all you need to start is just link your Gmail account to any debit card or bank account.

Unfortunately, this vantage them for two countries only, namely UK and USA, a bank account to link must be in these countries.

Charges, once the daily upper limit is reached, are – 2.9% + $0.30 USD of the total amount when receiving money.

7. Stripe

use stripe payment gateway extension

Businesses often face the problem of abandoned shopping carts and don’t want their visitors to redirect to the payment gateway website after adding products to the wishlist and once check-out is started.

Stripe comes to rescue exactly the y in this situation.

While disbursing money to a vendor using Stripe, an online shopper does not leave the website from where he/she is purchasing something, rather payment screens are displayed inside web pages of the same e-commerce site.

Implementation of Stripe can be done on any website that is created using any one or more of the following technologies-

- Ruby

- PHP

- Java

- Python

- Node.js(JavaScript) or

- iOS

100s of SMEs all over the world rely on Stripe to manage their payments day-to-day basis.

No chances of fraud, Stripe is a PCI Level 1 certified payment processor.

Its easy API connection procedure significantly increases its usage in tons of platforms, including Magento, Shopify, Prestashop, WooCommerce, etc.

Charges identical – 2.9% + $0.30 USD of the total amount when receiving money

8. WePay

use wepay payment gateway extension

Noticeably, WePay mainly focuses to provide payment solutions to large websites such as-

- websites categorized as ‘marketplaces’

- crowdfunding sites

- eCommerce stores of wholesalers

etc.

But this does not mean that it cannot be utilized for personal or individual non-commerce sites.

Due to its unique genre, the WePay payment processor comes in handy

- to sell event tickets

- accept donations and

- market products

via launching internet campaigns.

If you drive sales via credit card, WePay charges a flat rate of 2.9% + $0.30 per transaction but it decreases to 1% + $0.30 per transaction if you receive money through bank transfer.

9. Dwolla

Dwolla has reported daily processing of USD $1 million amount transactions.

It is relatively new in the space of popularly used payment gateways that work nicely with Magento.

If you are a start-up business that sells products or renders services with a subtle break-even point, Dwolla is immensely good as it takes no fees until you receive USD $10 per hour.

More than USD $10 in single dealing, you will pay $0.25 per transaction.

Sounds lucrative, isn’t it?

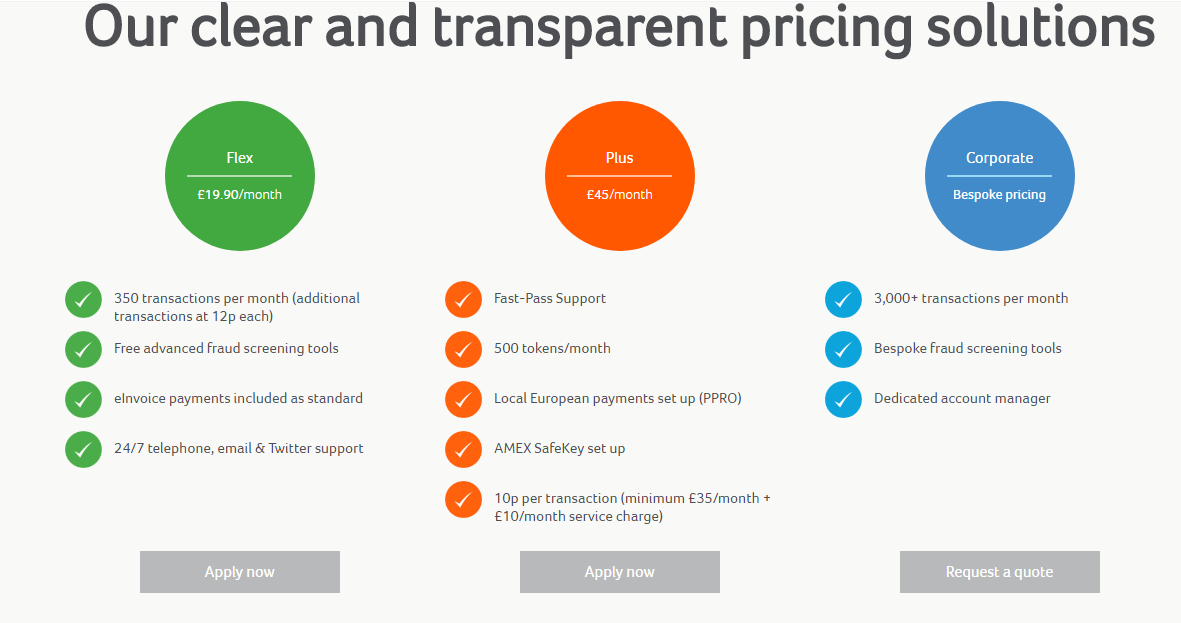

10. Sage Pay

Sage Pay has attracted the minds of tens of merchants by offering a payment system whose pages can be tailored to look just like other web pages of your website.

It is simple. It caters free set of industry-leading tools for fraud prevention.

Not only that, its dashboard is elaborate that gives valuable insights into the business by generating reports that print funds payments and receipts for a particular time period.

Alike other payment gateways, Sage Pay usually takes as little as 2 days timing to complete a bank transfer rather than 7 days.

Pricing Scheme:

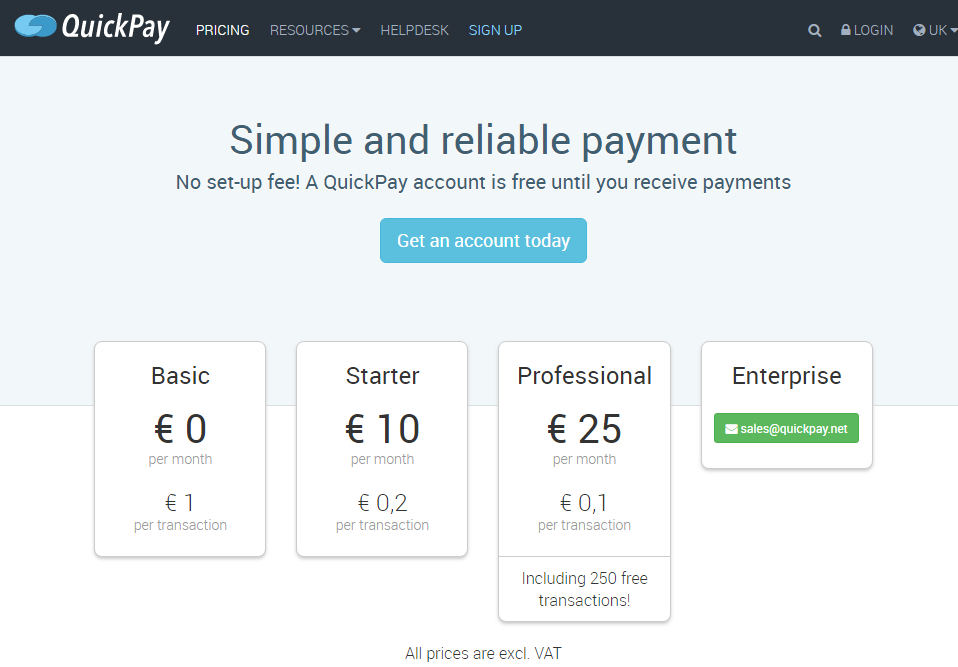

11. Quick Pay

A tax-aware payment system that can be well-integrated with Magento 2.0 or onwards version.

As of April 2018, 20,000+ customers/businesses are using it.

Interestingly, many public terminals/trade fairs over the globe use Quick Pay API to receive payments through the mail, phone or password.

No setup fees, charges for using:

A caveat on using payment services

Although the above statistics give an overview of facilities, charges, and drawbacks when making a financial transaction with a specific payment gateway, I have not revealed granular level details like invoice generation facility, number of invoices allowed per day, etc. which you should check.

I will throw light on these in upcoming posts.

This is pretty much, for now, visit this space for more news where MagentoGuys demystifies online payments and presents you with the Magento Development Process.